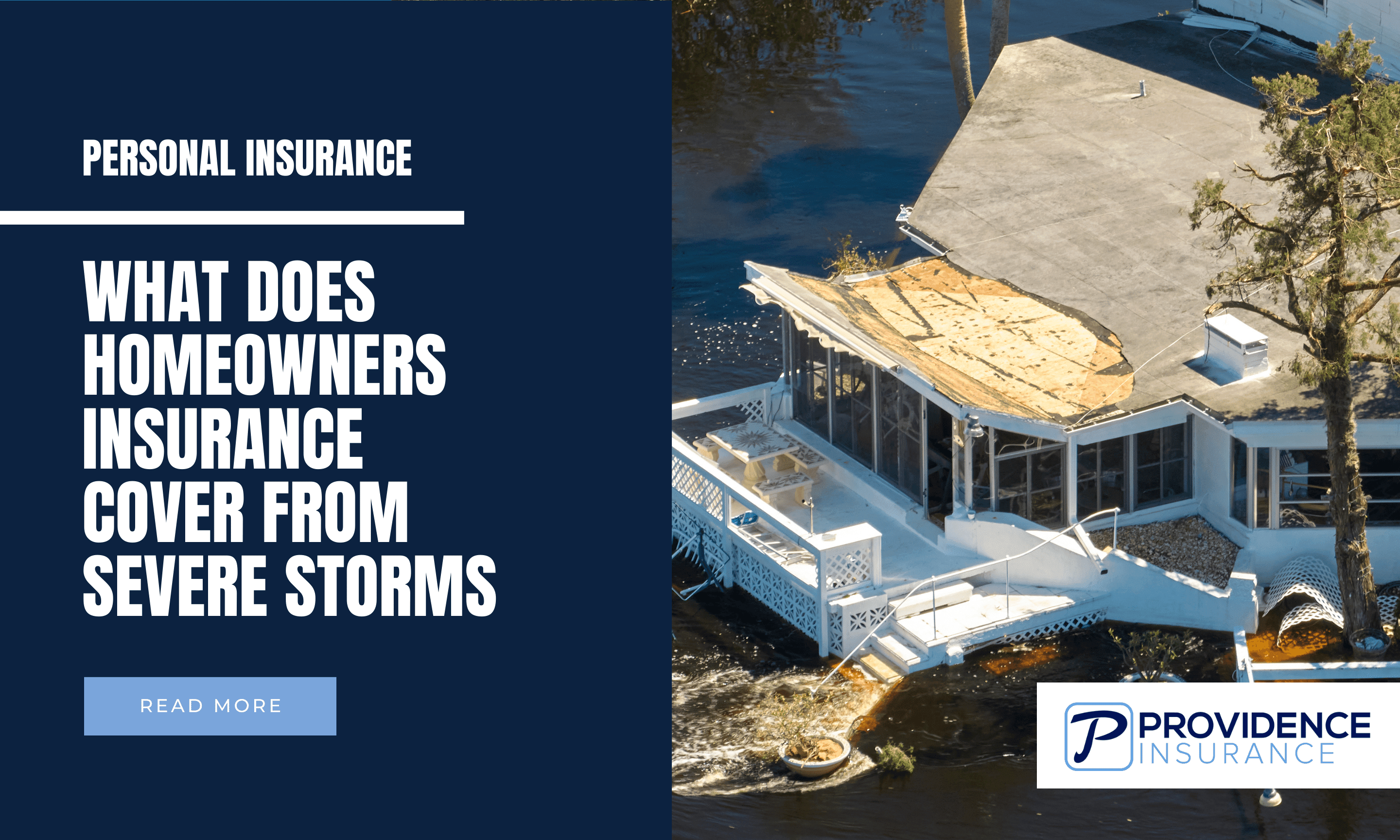

Severe storms can cause significant damage to your home and belongings, but does your homeowners insurance policy cover the costs of repairs and replacements? The answer depends on the type of storm and the type of damage. Here are some common scenarios and how homeowners insurance may help.

Wind Damage

Wind damage from storms such as tornadoes, hurricanes, and winter storms is typically covered by standard homeowners insurance policies. This means that if your roof, siding, windows, or other parts of your home are damaged by wind, your policy may pay for the repairs or replacements, minus your deductible. However, some policies may exclude or limit coverage for wind damage, especially if you live in a high-risk area such as on the coast. In that case, you may need to buy a separate windstorm insurance policy or a rider to your existing policy.

Hail Damage

Hail damage is another common type of storm damage that is usually covered by standard homeowners insurance policies. Hail can dent your roof, break your windows, or damage your car. Your policy may pay for the costs of fixing or replacing these items, minus your deductible. However, some insurers may require you to have a separate hail deductible, which could be higher than your regular deductible.

Flood Damage

Flood damage from storms such as hurricanes, tropical storms, or heavy rains is not typically covered by standard homeowners insurance policies. Flood damage can include water damage to your home’s structure, flooring, furniture, appliances, and personal belongings. To protect yourself from flood damage, you need to buy a separate flood insurance policy from the National Flood Insurance Program (NFIP) or a private insurer. Flood insurance policies have their own deductibles and limits, so make sure you understand what is covered and what is not.

Typically, rainwater in the home resulting from damage caused by wind is covered by a standard homeowner policy. For instance wind lifts your shingles and allows rainwater to intrude, the policy will likely cover the damage to the shingles and the interior damage caused by the rain.

Lightning Damage

Lightning damage from storms such as thunderstorms or electrical storms is usually covered by standard homeowners insurance policies. Lightning can cause fires, power surges, or electrical shocks that can damage your home or personal property. Your policy may pay for the costs of repairing or replacing these items, minus your deductible. Additionally, your policy may also cover the costs of living elsewhere if your home is uninhabitable due to lightning damage.

Earthquake Damage

Earthquake damage from storms such as seismic activity or volcanic eruptions is not typically covered by standard homeowners insurance policies. Earthquake damage can include cracks in your walls, foundation, chimney, or broken pipes or appliances. To protect yourself from earthquake damage, you need to buy a separate earthquake insurance policy or a rider to your existing policy. Earthquake insurance policies have their own deductibles and limits, so make sure you understand what is covered and what is not.

How to File a Homeowners Insurance Claim After a Storm

If your home is damaged by a storm, you should contact your homeowners insurance agency or company as soon as possible to file a claim. Your insurer will assign an adjuster to inspect the damage and estimate the costs of repairs or replacements. You should also document the damage with photos and videos and keep receipts of any expenses you incur due to the storm. You may also be eligible for additional living expenses (ALE) coverage if you have to live elsewhere while your home is being repaired.

Some tips to make the claim process smoother are:

– Review your policy and understand what is covered and what is not

– Follow the instructions of your insurer and cooperate with the adjuster

– Keep copies of all communication with your insurer and adjuster

– Avoid making permanent repairs until your claim is approved

– Ask questions if you are unclear about anything

– Appeal the decision if you are dissatisfied with the settlement offer

Conclusion

Homeowners insurance may cover storm damage depending on the type of storm and the type of damage. However, some types of storm damage are not covered by standard policies and require separate policies or riders. It is important to review your policy and understand what is covered and what is not before a storm hits. You should also contact your insurer as soon as possible after a storm to file a claim and get the help you need.

Check out our Homeowners Insurance Interactive Graphic for more information.